Personal Injury Protection in Texas: What You Need to Know

Navigating the Insurance Maze After a Motorcycle Accident

Legal Disclaimer: The information provided in this article about Personal Injury Protection in Texas: What You Need to Know is for informational purposes only and should not be construed as legal or professional advice. I am not a lawyer, and this communication does not create an attorney-client relationship. We are not a law firm, and therefore, any reliance on the information provided is at your own risk. A qualified attorney or insurance professional is needed to provide guidance tailored to your specific situation. Additionally, please be aware that by using the included links, we may be compensated at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases. Always consult with a qualified legal professional or insurance advisor for specific guidance.

Introduction

Dealing with insurance after an accident can be overwhelming, especially if you’re unfamiliar with policies like Personal Injury Protection in Texas. This post will explain why understanding PIP is crucial and how a motorcycle accident illustrates the complexities of insurance coverage.

The Motorcycle Accident: A Wake-Up Call

A young adult was severely injured in a motorcycle accident, shattering their femur. After the accident, the hospital requested the individual’s vehicle insurance information before processing any health claims. The family, shocked, learned that both health insurance companies refused to pay the claim until the motorcycle’s Personal Injury Protection in Texas was verified.

How Gen Z’s Financial Habits Impact Their Approach to Insurance

Given that financial habits can differ significantly between generations, it’s worth understanding how Gen Z’s approach to insurance might differ from their parents. Learn more about these generational differences:

Why Personal Injury Protection in Texas is Essential

In Texas, auto insurance policies must include Personal Injury Protection (PIP) unless the policyholder waives it in writing. This coverage helps pay medical expenses and lost wages, regardless of fault. The family in this story didn’t have immediate access to the required vehicle insurance information, which caused delays in the claims process.

Understanding Your Personal Injury Protection in Texas Coverage

It’s crucial to understand what your Personal Injury Protection in Texas covers, as many people mistakenly believe health insurance will cover all costs after an accident. This case shows the importance of reviewing both your health and auto insurance policies.

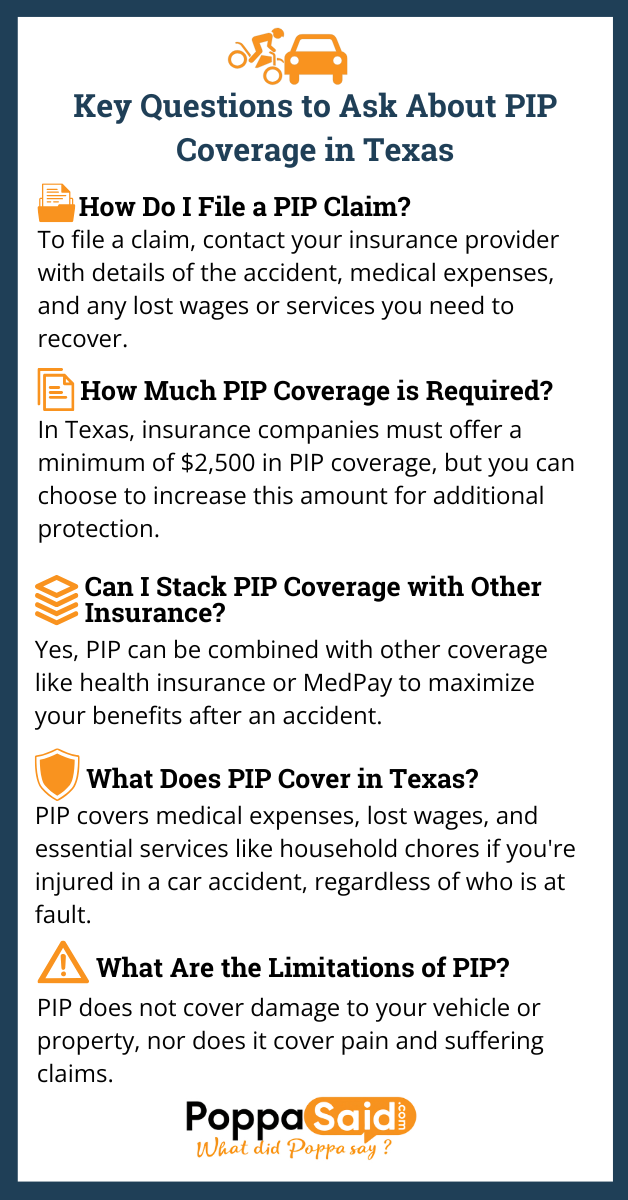

Key Questions to Ask About Personal Injury Protection in Texas

Make sure you know the answers to these questions about your Personal Injury Protection in Texas:

- Did you sign a waiver declining PIP?

- How much PIP coverage do you currently have?

- Does your health insurance coordinate with your vehicle insurance in the event of an accident?

Steps to Take After an Accident

To avoid delays in insurance claims processing, always:

- Keep copies of your vehicle insurance and PIP information readily available.

- Understand the details of both your health and auto insurance policies.

- Submit all relevant insurance information promptly after an accident.

Learn More About Personal Injury Protection (PIP) Coverage Options

Discover everything you need to know about Personal Injury Protection (PIP) auto insurance coverage and how it can protect you after an accident.

Summary of Personal Injury Protection in Texas

This story highlights the confusion and stress that can arise from not understanding Personal Injury Protection in Texas. By regularly reviewing your policies and ensuring you’re prepared, you can avoid unnecessary delays and financial strain.