Surprising Gen Z Financial Advice That Makes Sense

Disclaimer: This article explores Gen Z financial advice through a personal storytelling lens and is intended for general informational purposes only. It is not a substitute for legal, financial, or professional advice. Every financial situation is unique, so please consult with a licensed financial advisor or professional for guidance tailored to your specific needs.

“God gave you 5 senses. Use ’em.”

That’s what my grandfather always said—and my grandmother would echo it any time one of us wasn’t paying attention. She’d simply ask, “What did Poppa say?” and we knew: open your eyes, ears, and heart to what’s in front of you.

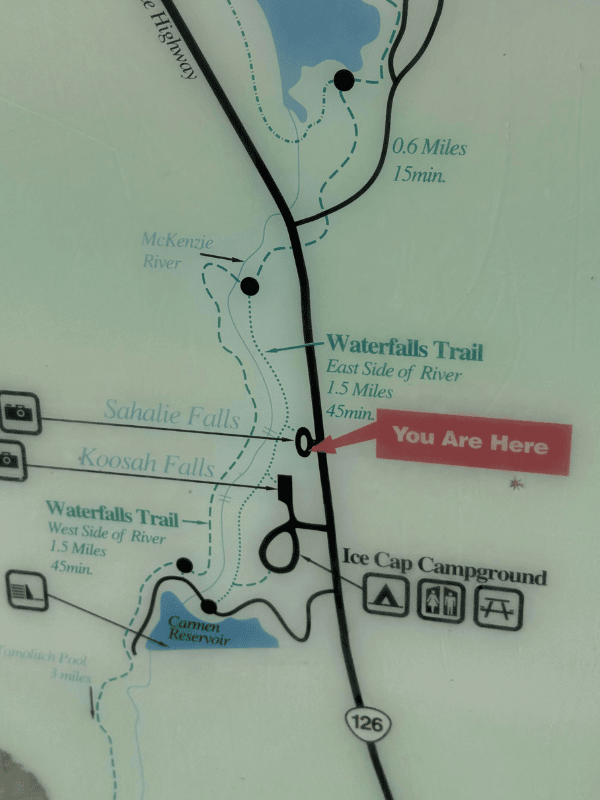

I thought I was using all five senses during a recent stop at Sahalie Falls in Oregon. But I was wrong. Two Gen Z strangers gave me a surprising lesson in Gen Z financial advice—one that reshaped how I think about money mindset and the emotional side of spending.

How Gen Z Financial Advice Surprised Me at Sahalie Falls

I stood at Sahalie Falls, iPhone 16 in hand, trying to capture 100 feet of raw Oregon beauty plunging into the McKenzie River. I’d followed a scenic route from Bend to Coos Bay, hoping to shoot content for my financial literacy brand, PoppaSaid.com. The waterfall was stunning—powerful, peaceful, and perfect.

Then it happened: a young man stepped directly into my frame.

My first instinct? Irritation.

I saw someone inconsiderate. I heard my plans unraveling. I felt my frustration rising.

But then I remembered Poppa’s words: Use your senses.

Really use them.

Gen Z Financial Advice: Choosing Connection Over Conflict

Instead of sighing or making a passive-aggressive comment, I paused. The young man and his friend headed down the steep riverbank to get their shots. When they climbed back up, I made a decision that shifted everything I thought I knew about Gen Z financial advice.

I chose connection over conflict.

“Excuse me,” I said. “I noticed you have a video camera. I’m actually in financial literacy too. Mind if I ask you something?”

What happened next shattered every assumption I had about Gen Z money mindset and emotional spending habits.

The Assumptions I Got Wrong About Gen Z Financial Advice

- Their ages: I assumed they were teenagers. They were actually 23 and 22.

- Their careers: I figured they were just messing around. One was an engineer. The other, a scientist.

- Their financial awareness: I expected them to need basic financial education. Instead, they shared real wisdom about small spending habits—the kind most adults still struggle with.

- Their intentions: I thought they’d blocked my shot without a second thought. But they had no idea—they were just as focused on their creative work as I was on mine.

The Question That Reveals Gen Z Money Mindset

During my travels, I’ve been asking Gen Z the same financial literacy question:

“If you could be 18 again, what advice would you give yourself about money?”

After this encounter, I realized it needed the PoppaSaid touch:

“What would you tell your 18-year-old self about money—what did your family teach you that you wish you’d listened to?”

The engineer’s answer hit me like that waterfall:

“I would tell myself to not be as frivolous with buying small things because small things add up and make a big difference.” — Edwin, age 23, Engineer

His response struck deep. He understood something many financial advisors overlook: it’s not the big purchases that derail us—it’s the small spending habits.

If you’re struggling with these same small spending habits, a simple weekly money tracker pad can help you see exactly where those $5–$20 impulse purchases go.

For more practical solutions to track spending and stay accountable, check out our guide to Top Budgeting Tools for 2025 — it’s packed with Gen Z-friendly picks.

Apps are great—and I list some later—but sometimes old school is the best school. As my mother used to say, seeing (on paper) is believing. Sometimes we need to literally write it down to believe it.

The Emotional Side of Money: Beyond FinTok Financial Advice

These two young professionals understood something most financial advisors miss: the emotional complexity of money.

The engineer grasped the hidden weight of small purchases. The scientist had learned to balance present joy with future goals.

They weren’t talking about budgeting apps or investment strategies. They weren’t quoting FinTok or sharing viral finance hacks.

They were talking about feelings. About the emotional side of money—something I had been overlooking in my own business.

That moment sent me back to a book I had skimmed before, but never truly absorbed:

“Your Money or Your Life” by Vicki Robin

The updated edition speaks directly to Gen Z, reframing money as life energy—not just numbers. It’s about the emotional and psychological relationship with money that these young men had already internalized.

Using All Five Financial Senses in Business

Standing beside Sahalie Falls, I realized something important: I’d been operating my business with only partial sensory input.

- Financial Sight: I was focused only on products—wills, term life insurance, and spending analysis—not the emotional landscape of Gen Z money mindset.

- Financial Sound: I was hearing my own sales pitch, not listening to the real stories behind small spending habits and money emotions.

- Financial Touch: I was reaching for transactions instead of touching the hearts behind financial decisions.

- Financial Taste: I was tasting the bitterness of resistance instead of savoring the sweetness of authentic connection.

- Financial Smell: I was missing the subtle scent of fear, shame, hope, and dreams that surrounds every conversation about money.

Money Mindset Transformation: The Business Pivot

What did Poppa say? Use your senses.

In that moment, PoppaSaid.com stopped being just a brand—it became a framework for understanding Gen Z financial literacy.

Instead of pushing products, I need to:

- See people as whole humans with complex money emotions—not just potential customers

- Listen to their struggles with small spending habits—not just their surface needs

- Feel the connection before any transaction

- Taste the meaningful moments—like this one at Sahalie Falls—that reveal true wisdom

- Touch lives with multi-generational financial wisdom, not just financial tools

The engineer and scientist showed me something powerful: Gen Z doesn’t need another app or insurance pitch.

They need someone who understands that every money decision carries emotional weight, cultural expectations, and a story shaped by family.

Beyond Social Media: Real Gen Z Financial Wisdom

FinTok advice is everywhere—but that day at Sahalie Falls reminded me:

Real wisdom can show up unannounced and block your shot.

Maybe that “disruption” is actually the clearest vision of all.

The engineer’s insight? Tiny purchases reflect deep habits.

The scientist’s lesson? Enjoy today, plan for tomorrow—with emotional intelligence.

One tangible way to build that kind of mindset is with a clear acrylic piggy bank that must be broken open to access the savings. Seeing your cash grow without the temptation to dip into it reinforces intentional saving—and makes future goals visible today.

Social media is full of tips and hacks, but that moment at Sahalie Falls went deeper.

Two strangers became teachers. They reminded me that wisdom doesn’t always come from age, money, or first impressions.

Sometimes the people who block your frame are the ones helping you see more clearly.

These two young professionals showed me that Gen Z financial advice isn’t about apps or pitches.

It’s about understanding that every financial decision carries emotional weight, personal fears, family history, and cultural expectations.

The engineer’s insight—that small spending habits add up—wasn’t about budgeting alone. It was about how repeated tiny choices reflect deeper values.

And the scientist? His perspective on balancing joy and planning wasn’t just smart—it was emotional intelligence in action.

Multi-Generational Financial Wisdom: What Did Your Poppa Say?

As I drove away from Sahalie Falls, I didn’t just leave with waterfall photos—I left with purpose.

PoppaSaid.com is no longer just about financial products. It’s about:

- Honoring multi-generational financial wisdom

- Connecting traditional advice with Gen Z money mindset

- Bridging emotional literacy with practical tools

My grandfather’s words—“God gave you 5 senses. Use ’em”—led me to a truth I’d overlooked until Gen Z helped me see it clearly.

Your Financial Wisdom Story

So here’s my question to you:

What did your Poppa, your grandmother, or your family say about money that you wish you’d listened to sooner?

Because sometimes the most powerful financial advice doesn’t come from Wall Street or FinTok.

It comes from the people who loved us enough to teach us how to feel the truth behind every dollar—long before we knew how to calculate it.

About PoppaSaid Financial Literacy

What did Poppa say in your family?

At PoppaSaid.com, we focus on the emotional side of money—helping people understand their spending habits while honoring multi-generational financial wisdom.

We believe the best financial advice doesn’t always come from banks or influencers.

It often comes from family—and from the simple, powerful tools that help us see, hear, and feel our way toward better money decisions.

Follow PoppaSaid.com for more Gen Z financial advice, emotional money insights, and multi-generational wisdom that shapes how we earn, spend, and save—together.